Dismissing the implications of an antitrust regulatory review not seen in the United States for years, AT&T this morning officially unveiled its intention to acquire T-Mobile in a $39 billion deal that will give AT&T nearly 40 percent of the American wireless market.

Dismissing the implications of an antitrust regulatory review not seen in the United States for years, AT&T this morning officially unveiled its intention to acquire T-Mobile in a $39 billion deal that will give AT&T nearly 40 percent of the American wireless market.

With a combination of the two companies, the new super-sized AT&T would become America’s largest wireless operator, and deliver nearly three out of every four wireless customers to just two companies — AT&T and Verizon.

Wall Street is delighted.

“Phenomenal deal if it happens,” said Jonathan Chaplin, an analyst with Credit Suisse Group AG. “Huge upside for AT&T — [T-Mobile owner] Deutsche Telekom getting a great price; however, we believe regulatory risk is enormous.”

That may prove an understatement, if public interest groups have their way.

“The combination of the second-largest wireless carrier, AT&T, with the fourth-largest, T-Mobile is, as former FCC Chairman Reed Hundt once said, ‘unthinkable,'” said Public Knowledge President Gigi Sohn. “We urge policymakers to think similarly today. The wireless market, now dominated by four big companies, would have only three at the top. We know the results of arrangements like this – higher prices, fewer choices, less innovation.”

“It’s difficult to come up with any justification or benefits from letting AT&T swallow up one of its few major competitors,” said Parul P. Desai, policy counsel for Consumers Union. “AT&T is already a giant in the wireless marketplace, where customers routinely complain about hidden charges and other anti-consumer practices.”

“I think it could reach some level of controversy,” said an antitrust expert, who worked for the Justice Department’s antitrust division. “There’s going to be spectrum issues. This is going to be a complex deal and I don’t think it’s a foregone conclusion that it will be approved.”

Despite the concerns, AT&T is confident that regulators have been sufficiently cowed by the company’s lobbyists to approve just about anything they bring to the table.

AT&T CEO Randall Stephenson told reporters on a conference call that the company spent plenty of time doing “homework” on how to get the deal to pass regulator scrutiny.

The American carrier even bet its winning outcome with a $3 billion cancellation fee, payable to Deutsche Telekom if the deal cannot be consummated.

In AT&T’s presentation this morning, the company promised they would improve America’s worst-rated cell phone company by merging with America’s second worst-rated cell phone company. Specifically, AT&T says the deal will bring T-Mobile’s wireless spectrum allocations to the larger carrier, which can alleviate spectrum shortages. The company also promised, in return for deal approval, expand service in more rural locations and quicker upgrades to the next generation of speedy wireless data — LTE.

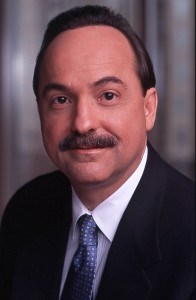

Ralph de la Vega, AT&T’s president and CEO of Mobility and Consumer Markets, showed slides promising T-Mobile customers would benefit from new choices in cell phones and would enjoy AT&T’s far larger nationwide network, delivering improved service. But he also hinted it would cost value-oriented T-Mobile customers, promoting the deal’s potential of winning new revenue from customers soon forced to pay AT&T’s significantly higher prices.

AT&T claimed the company still would face robust competition from Verizon, Sprint, and a number of much-smaller regional carriers like MetroPCS and Leap Wireless’ Cricket — themselves under pressure to merge. But consumer groups are skeptical.

“Don’t believe the hype: There is nothing about having less competition that will benefit wireless consumers,” said Free Press Research Director Derek Turner. “And if regulators approve this deal, they will further cement duopoly control over the wireless market by AT&T and Verizon.”

“The FCC’s National Broadband Plan, issued last year, warned about the absence of sufficient competition in the wireless market. The possibility that three players would control nearly three-quarters of that market will surely trigger intense scrutiny by the agencies,” said Andrew Schwartzman of Media Access Project.

The deal has been under negotiation for several months between the German carrier and AT&T. Many Wall Street analysts see the deal as a major win for T-Mobile, which has struggled mightily against the AT&T and Verizon juggernauts. The German company wins a seat on AT&T’s board, a part interest in the carrier, and a high valuation on its network. AT&T gets the country’s only other major carrier using the same technology it does — GSM — and picks up the potential of more robust coverage in the urban and suburban areas T-Mobile focuses on. AT&T will also follow the time honored tradition of buying something they cannot afford outright — they will finance it with a generous credit line arranged by J.P. Morgan Chase.

[flv]http://www.phillipdampier.com/video/CNBC Mergers and Acquisitions ATT and T-Mobile Merger to Create Industry Giant 3-21-11.flv[/flv]

CNBC managed to achieve an exclusive interview with the CEOs of AT&T and T-Mobile about their merger. As with most business media, don’t expect a lot of challenging questions in response to the claims made by the company executives about the merger or its impact on consumers. (20 minutes)

Subscribe

Subscribe

Honestly, this make me angry. Before choosing T-Mobile, I evaluated my choices and AT&T came in last due to customer service issues, expensive plans, and unfair blocking of many built-in Android features. Now they want to force me into being their customer? I don’t think so. This is utterly unfair to us T-Mobile customers who are perfectly happy with the level of service and choice of phones we receive. Not to mention how anti-competitive this is. Going from four to only three carriers is bad enough, but they would become the sole GSM carrier in the country. If you want… Read more »

Of course it sounds great to both companies, it’s a money party for the management teams involved as tens of millions of dollars will get pocketed by the executives, and as fees by the lawyers and banks involved in the merger. Losing T-Mobile is just unacceptable, it’s not that they’re just another wireless provider, they’re the only relatively low-cost GSM provider in the market that has provided plans that are innovative or disruptive against the large carriers such as AT&T and Verizon. You can also expect given the huge debt load being created to finance such as a merger that… Read more »