Unless you own Sprint’s premiere smartphones — the Evo 4G and the Epic, get out your wallet — Sprint is increasing the price on its unlimited data plan by $10, effective later this month.

Unless you own Sprint’s premiere smartphones — the Evo 4G and the Epic, get out your wallet — Sprint is increasing the price on its unlimited data plan by $10, effective later this month.

Evo and Epic owners already pay the $10 “premium data” fee that will be extended to all smartphone customers Jan. 30 (customers on existing contracts will not be affected).

The reason for the price increase? Heavy usage on its wireless network, which partly includes Virgin Mobile (ending its unlimited service Feb. 14) and Clearwire, which heavily throttles speeds of customers deemed to be “using too much.”

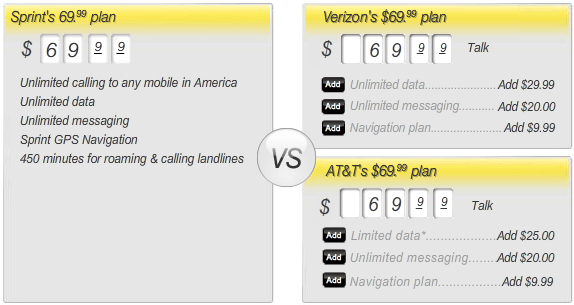

Chief executive Dan Hesse says Sprint will retain its unlimited service plans, which the company calls the best value in the wireless industry. But the pricing change will present minor challenges as Sprint markets themselves as the least costly.

Sprint's marketing focuses on its unlimited use offers, some of which are about to get more expensive.

Sprint’s “Everything Data” plan, which also includes unlimited cell-to-cell calls will now cost $79.99 per month. Comparable plans from T-Mobile are priced at $99.99 for that company’s 4G network and $119.98 on Verizon Wireless’ slower, but more ubiquitous 3G network.

“Sprint has been the price leader in the market,” said Jennifer Fritzsche, a Wells Fargo & Co. analyst in Chicago who has an “outperform” rating on the stock. “Sprint may be more confident in the pricing power it has with customers.”

The Wall Street Journal also shares positive views of the price increase from Wall Street:

Wall Street applauded the move, with many seeing it as a sign of pricing power returning to the wireless industry. “It is more likely that Sprint believes that consumers value unlimited and that they can get away with higher pricing,” said Jonathan Chaplin, an analyst at Credit Suisse.

The price hike also suggests that Sprint has seen stronger smartphone growth over the past three months, he added, noting that the carrier likely wouldn’t have made the change if it were still concerned about stabilizing its base on contract customers.

But some other analysts are less impressed with Sprint, especially because of challenges the company faces with its Clearwire partnership.

Patrick Comack from Zachary Investment Research has downgraded Sprint stock, particularly because of technology issues Clearwire faces.

Comack told CNBC Clearwire is stuck with defective spectrum for much of its wireless broadband service.

“It can’t penetrate walls,” Comack said, noting most Clearwire customers are trying to use wireless broadband in the 2GHz range, which presents plenty of problems from obstacles between the tower and the customer.

Comack also believes Sprint’s network simply cannot compete with Verizon Wireless, which he suspects could pick up a number of Sprint customers once it fully activates its 4G network nationwide.

Verizon Wireless network delivers significantly better coverage than Sprint, which focuses on urban and suburban markets, and the major highways that connect them.

[flv]http://www.phillipdampier.com/video/CNBC Sprint 1-12-11.flv[/flv]

CNBC: Debating Sprint and Clearwire, with Todd Rethemeier, Hudson Square Research and Patrick Comack Zachary Investment Research. (6 minutes)

(Thanks to Stop the Cap! reader PreventCAPS for sharing the news.)

Subscribe

Subscribe