While the passage of the CARD Act has protected consumers from some of the worst credit card tricks and traps, the legislation left plenty of loopholes which credit card companies are increasingly exploiting to minimize risk and generate additional revenue. As credit card companies continue to reduce credit limits and close accounts, both permitted under the legislation, they are increasingly using “excessive credit inquiries” as an excuse for taking that action.

That’s why one Raleigh, N.C. Time Warner Cable customer was very unhappy to see not one, but two credit inquiries on his credit report from the cable company when he signed up for service back in July:

TIME WARNER CABLE - RALEIGH Hide Details 07/13/10, 07/12/10

These “hard pulls” appear on credit reports under the “inquiries” section and are provided to other creditors as an indication of how much new credit you are applying for over a two year period. While one or two of these inquiries are unlikely to dramatically impact your overall credit score, someone moving to a new home or planning to purchase one might run into some reluctant creditors unwilling to extend credit at the best possible rates for those who have six or more inquiries in the last 12 months.

According to Fair Isaac, the company that produces the FICO score, those with six or more inquiries on their credit reports are up to eight times more likely to declare bankruptcy than people with no inquiries on their reports.

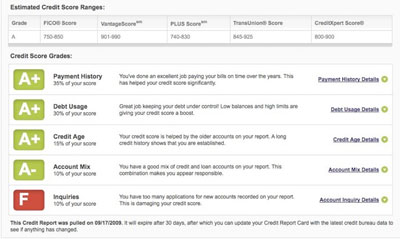

As credit card issuers continue to be risk averse, a sudden appearance of hard inquiries on a credit report can be enough to deny you approval for a new account or help trigger a “credit review” which, in combination with other factors, can lead to a major credit line reduction or even account closure.

Pentagon Federal Credit Union, one of the nation’s best-rated credit unions, is also among the most sensitive to lots of inquiries, fearing potential customers are “pyramiding credit” through rapid fire applications.

Time Warner Cable is not alone in pulling credit reports on their new customers. Comcast, AT&T, DirecTV and Verizon also obtain credit reports for customers signing up for cable, satellite, landline, and/or mobile service, and some customers have seen their FICO scores drop as a result.

Fair Isaac says the impact from inquiries will vary from person to person based on their individual credit histories. For most people, one additional credit inquiry will take less than five points off their FICO score. But inquiries can have a greater impact if you have few accounts, a short credit history, are trying to rebuild credit, or are on the edge of moving from one score range to another. Some creditors that manually check applications may ignore or discount credit inquiries from cable and phone companies, because it’s not the same as applying for a credit card, but automated systems may not be so forgiving.

More upsetting to some are why these companies are placing hard inquiries for credit reports on their subscribers’ credit files in the first place, especially when many customers had no idea they would try.

“Creditors can review credit reports and report them to credit bureaus as “soft” or “hard” inquiries,” writes our reader Tabitha, who had her credit report pulled when she called requesting a lower rate from Comcast. “If they make a soft inquiry, that’s no big deal because no other creditors will see this on your report. But Comcast made a hard inquiry and that does show up and it dropped my FICO score six points.”

Tabitha moved into her Philadelphia-area home eight months ago, opening a new checking account, establishing accounts with local utility and cable companies, switching her cell phone carrier, and dealing with Comcast. Altogether, that resulted in six hard inquiries on her credit report.

And many credit card companies absolutely hate to see that. Here’s a copy of a letter rejecting one consumer’s request for credit because there were “too many inquiries” for credit in his or her credit file:

Chase hates to see a lot of inquiries from creditors on credit reports. That alone can be sufficient to deny you credit from them. (Click to enlarge)

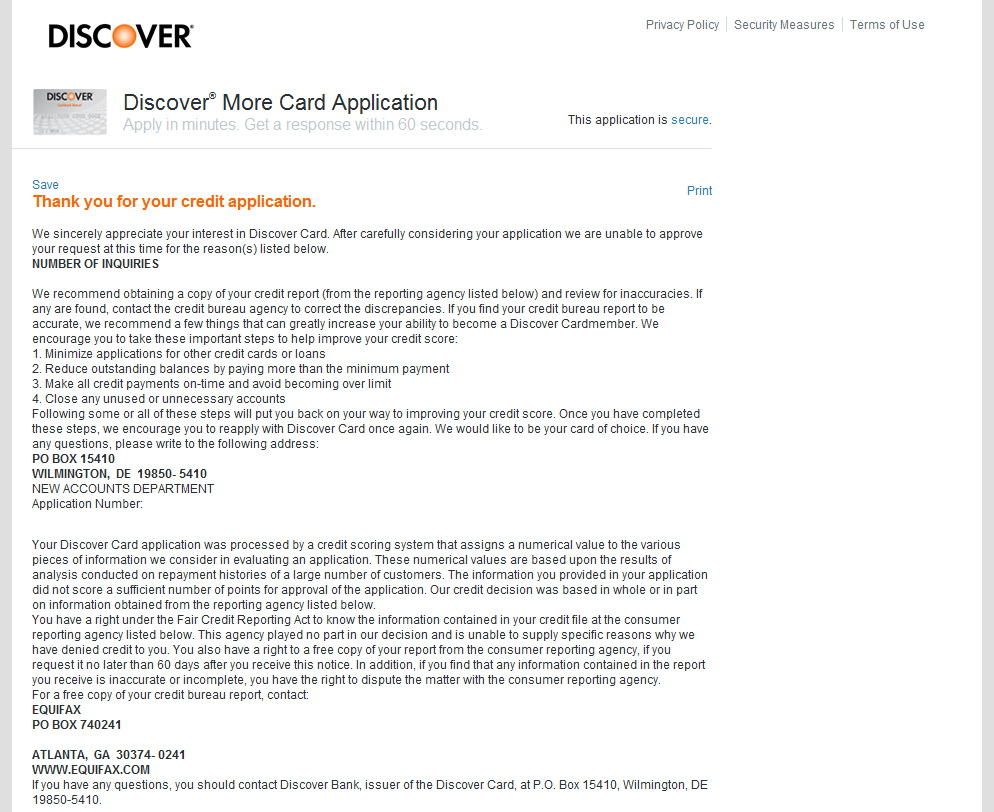

If Discover Card discovers a whole mess of inquiries on your credit report, you’ll discover a rejection letter from them in no time at all, as this customer discovered:

Discover Card's automated credit analyst software will reject credit requests out of hand if there are too many hard inquiries on your credit report. (Click to enlarge)

We have been able to find credit inquiries from cable and phone companies for everything from establishing service as a new customer to relocating to a new address or even upgrading or downgrading your level of service. Establishing postpaid cell phone service almost always has resulted in a credit report pull, and most customers are aware of that when they sign up. But should a cable company do a credit check just for calling them up and asking for a lower rate?

Bargaineering has some tips to help get these inquiries permanently deleted from your credit report from all three major credit bureaus. It can be as easy as just writing a letter. The Time Warner Cable customer in Raleigh called the cable company to demand they remove at least one of the duplicate hard inquiries, and Time Warner managed to do him one better by deleting all of them from his credit file, which suits him just fine.

Subscribe

Subscribe