McAdam

Verizon CEO Lowell McAdam wants you to spend more with the phone company, and if his vision of Verizon’s future comes true, you will.

The company’s newest CEO spoke on a wide-ranging number of topics for the benefit of Wall Street investors at the Guggenheim Securities Symposium. A transcript of the event delivers several newsworthy revelations on the company’s future plans.

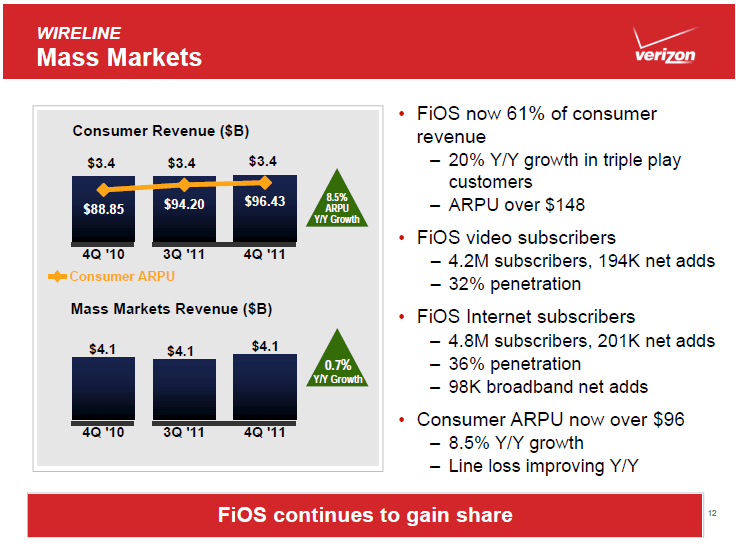

McAdam rose through the ranks of Verizon Communications with a specialty in the company’s immensely profitable wireless business. His predecessor, Ivan Seidenberg, spent his career at Verizon Communications working with the company’s legacy wireline (landline) network. While Seidenberg envisioned a new future for Verizon’s landline business with an upgraded fiber optic network called FiOS, McAdam maintained a different vision having run Verizon Wireless as a profit-making machine since 2006. McAdam believes Verizon’s future earnings and focus should be primarily on the wireless side of the business, because that is where there is serious money to be made.

“The first thing I did when Ivan sort of named me as the Chief Operating Officer was we had a very well-defined credo in the wireless side,” McAdam said. “We created it when we first came together in ’99 because we had seven different companies and we knew we had seven different cultures and we needed to tell people what it was we were really looking for. So we created that document. We spent a lot of time on it. We do a lot of reward and recognition as a result of it and that culture really took root in wireless.”

McAdam’s leadership also aggressively challenged the long-standing telephone company philosophy of earning a stable, predictable profit as Verizon did when it was a regulated monopoly. Instead, McAdam shifted the work culture towards an obsession with shareholder value.

“We took the top 2000 leaders through what we call ‘Leading for Shareholder Value’ and that was really a cultural shift for us because, if you think about it, the wireline side of the business has come out of the defined rate of return culture and we left that competitively a while ago. I am not sure we left it culturally,” McAdam said. “So we have been far more pushing why do you make that investment, what is the return on it, what is the priority of that investment versus another investment.”

Verizon’s Plans to Abandon Rural Landline Customers – Sign Up for Our Expensive LTE 4G Wireless Broadband With a 10GB Usage Cap Instead

Some of the most revealing commentary from McAdam came in response to questions about what Verizon plans to do with its enormous landline phone network, dominant in the northeastern United States.

Some of the most revealing commentary from McAdam came in response to questions about what Verizon plans to do with its enormous landline phone network, dominant in the northeastern United States.

In comments sure to alarm rural Verizon customers from Massachusetts to Virginia, McAdam clearly signaled the company is laying the groundwork to abandon its rural phone network (and DSL broadband) as soon as regulators allow. Dave Burstein at DSL Prime estimates that could impact as many as 18 million Verizon customers across the country.

“In […] areas that are more rural and more sparsely populated, we have got [a wireless 4G] LTE built that will handle all of those services and so we are going to cut the copper off there,” McAdam said. “We are going to do it over wireless. So I am going to be really shrinking the amount of copper we have out there and then I can focus the investment on that to improve the performance of it.”

Elsewhere, in more urban and suburban areas, McAdam also wants Verizon to purge its network of copper.

“The vision that I have is we are going into the copper plant areas and every place we have FiOS, we are going to kill the copper,” McAdam said. “We are going to just take it out of service and we are going to move those services onto FiOS. We have got parallel networks in way too many places now, so that is a pot of gold in my view.”

In other words, McAdam would shift money spent maintaining and upgrading rural landline service into the company’s wireless network in rural America and its FiOS network in more urban environments, both of which will improve profits. FiOS allows Verizon to pitch television, broadband, and phone service in one profitable triple-play package, while also discontinuing standalone DSL service. Rural customers pushed to wireless LTE for broadband will face onerous usage limits and more expensive service for phone calls and broadband. Using Verizon’s LTE network for video would be prohibitively expensive.

In other words, McAdam would shift money spent maintaining and upgrading rural landline service into the company’s wireless network in rural America and its FiOS network in more urban environments, both of which will improve profits. FiOS allows Verizon to pitch television, broadband, and phone service in one profitable triple-play package, while also discontinuing standalone DSL service. Rural customers pushed to wireless LTE for broadband will face onerous usage limits and more expensive service for phone calls and broadband. Using Verizon’s LTE network for video would be prohibitively expensive.

McAdam hints the company has used its lobbyist force to make preparations to abandon rural customers first in Florida, Virginia, and Texas where state regulators approved legislation that eliminates the requirement Verizon serve as “the carrier of last resort.” That law required Verizon to deliver landline phone service to any customer in its service area on request. With that provision stricken in those three states, Verizon can abandon any landline customer it chooses after serving written notice.

McAdam said he intends to continue lobbying other states to adopt similar deregulation, and chided legislatures in both New York and New Jersey for “being backward” because they have repeatedly refused to allow Verizon to walk away from its rural customer obligations.

Burstein thinks the changes in progress at Verizon will be a disaster for affordable rural broadband.

“This makes a mockery of ‘affordable broadband,’ especially when Verizon and AT&T are boycotting the plan for discounts for poor schoolchildren,” Burstein says. “The detente between telcos and cable companies means the prices of modest Internet speeds (3-15 megabits down) are typically going up from $30-45 to $55-70.”

Burstein also notes the change spells disaster for competitors who sell DSL service over existing phone networks.

“Nationwide, alternatives to the telco/cablecos have less than 5% of the residential market but in some areas they remain important,” Burstein says. “The most interesting, Sonic.net in California, offers unlimited calls and Internet up to 20 meg for $50/month, 20-50% cheaper than AT&T.”

“High prices, unacceptable service choices and further rural depopulation are bad policy,” he adds.

Verizon still earns enormous revenue from its remaining landline customers, revenue McAdam hopes will be replaced by selling business-focused services instead.

“Cloud [service] is continuing to pick up for us. Security is I think going to be an even more important play for us as we go forward,” McAdam noted. “I think these large enterprise accounts, offering them kind of a global service with those up the stack […and…] applications on top of it drive it as well. So there is a number of pieces in the portfolio that I think will take us up and more than compensate for some of the falling off of copper-based services like DSL and voice and that sort of thing.”

Verizon’s Unionized Employees Are Wrong-Headed Defending Verizon’s Landline Network

McAdam also blamed the company’s unionized employees for remaining loyal to the company’s traditional role in the landline business. Unions like the Communications Workers of America continue to push Verizon to expand its FiOS fiber optic network in more places, but the company has left its FiOS expansion on hold, diverting investment into its wireless business. Both McAdam and the union agree the days of copper wire networks are numbered, but McAdam hints that union concessions (and fewer unionized employees) are required before the company will again expand FiOS.

McAdam also blamed the company’s unionized employees for remaining loyal to the company’s traditional role in the landline business. Unions like the Communications Workers of America continue to push Verizon to expand its FiOS fiber optic network in more places, but the company has left its FiOS expansion on hold, diverting investment into its wireless business. Both McAdam and the union agree the days of copper wire networks are numbered, but McAdam hints that union concessions (and fewer unionized employees) are required before the company will again expand FiOS.

“Our employees see that it is not sustainable to keep having copper plant out there. You really can’t invest in it; it is difficult to maintain it; and they want to see us improve on FiOS,” McAdam said. “And when I am out in the field, the techs and the reps will be the first to point out kind of some of the dumb policies I call them that we have around the business. Well, a lot of those are based on rules that were negotiated with the union back in the ’60s and ’70s.”

“So we have to get the union leadership to understand that if the company is able to be more flexible in meeting customer needs then we can grow things like FiOS, which will provide good long-term jobs,” McAdam added. “Will it be the same number as what we had in the past? No.”

Verizon’s Enormous Offshore Bank Accounts: Waiting for a ‘Business-Friendly’ Administration to Let Them Bring the Money Back, Tax-Free

McAdam also signaled investors that the phone company’s profits massed in overseas bank accounts are going to remain in place until they know who wins the next election. Verizon wants to repatriate some of that offshore money, but they want to do it tax-free.

“Everybody is kind of waiting to see who controls the Senate and who controls the White House and they are waiting to make those — you have got to understand what the tax situation is going to look like, so we are all waiting to make those investments,” McAdam said.

‘Share Everything’ Lays the Foundation to Monetize Your Data Usage… Forever

McAdam is a big supporter of the company’s new Share Everything wireless plan, which charges smartphone owners $90 a month for unlimited voice calling, texting, and a small 1GB bucket of data that he is convinced customers will be prepared to spend more to enlarge.

McAdam is a big supporter of the company’s new Share Everything wireless plan, which charges smartphone owners $90 a month for unlimited voice calling, texting, and a small 1GB bucket of data that he is convinced customers will be prepared to spend more to enlarge.

“If I know that I have an intelligent home that I can get to any number of ways. If I know that I can do everything I want in my car that I can do in front of my TV set or my PC or on my tablet, I think it just takes away a lot of the restraints,” McAdam said. “Is it going to cost them more money? Yes, but it will probably shift their wallet spend from other things that they do individually into this sort of a bucket of gigabytes. And so I think it will be a significant [revenue] stream for us.”

FitchRatings, a credit ratings agency, agrees in a new report.

“The new pricing structure taken by the industry leader is a disciplined pricing action that could create more cash flow stability longer term within the wireless industry,” the credit ratings agency said last week.

Fitch notes data services are increasingly becoming a larger source of revenue for wireless phone companies. In the first quarter alone, data revenues at Verizon Wireless, AT&T, and T-Mobile USA — all carriers that abandoned flat rate wireless data plans, grew 19% year over to year to $14.2 billion. That represents 41 percent of the companies’ service revenues.

Despite assertions from Verizon that the new plans deliver convenience and better value for subscribers, Fitch found they actually represent a substantial price increase for many customers.

“These increases are sometimes material, depending on whether the legacy rate plans have low recurring charges for text messaging or calling minutes. As a result, prices have generally increased for new subscribers,” Fitch reports.

“These increases are sometimes material, depending on whether the legacy rate plans have low recurring charges for text messaging or calling minutes. As a result, prices have generally increased for new subscribers,” Fitch reports.

Fitch warns investors Verizon is likely to lose customers over its new pricing strategy, and experience a slowdown in new customer growth as well, at least until competing carriers realign their pricing and plans to be similar (or match) those Verizon introduced last month.

The Days of Your Subsidized Android/iPhone May Be Numbered

McAdam’s vision also includes a re-examination of device subsidies as customers increasingly depend on wireless devices. McAdam previously indicated the wireless device subsidy was designed to get customers to adopt and embrace new technologies, and as adoption rates have soared, the need to keep discounting technology that customers depend on diminishes.

He echoed that sentiment at the Guggenheim Securities Symposium, noting that Verizon this month abandoned subsidies on tablet devices. For McAdam, discounting wireless technology serves one purpose: to quickly establish a new business relationship with a customer that probably would not buy their first device at full price.

But McAdam recognizes changing the company’s subsidy that customers expect to receive must happen gradually. It has already started, first by eliminating early upgrade discounts, then by dropping the company’s loyalty discount “New Every Two” plan. Now, the company will only allow grandfathered unlimited data plan customers to keep those plans if they agree to forego any subsidy on their next smartphone.

“If you look at the telematics industry today [services like OnStar], the car companies subsidize a device that goes into the car. So I think that we have a tendency over the years to sort of look and say, oh, something is going to happen very quickly,” McAdam said. “Things have a tendency to evolve over a long period of time, so I think you will have some devices, like the tablet today, that [are] not subsidized and you’ll probably still have certain devices that are because you want to establish that relationship with a customer and that is the easiest way to get there.”

Verizon Wants You to Use the Cable Industry’s Growing Wi-Fi Network

McAdam’s vision also offloads as much of Verizon’s 3G and 4G traffic to other networks as possible. Ironically, one of the biggest networks he hopes customers will use instead of his are the growing number of Wi-Fi services offered by his competitors in the cable industry.

McAdam’s vision also offloads as much of Verizon’s 3G and 4G traffic to other networks as possible. Ironically, one of the biggest networks he hopes customers will use instead of his are the growing number of Wi-Fi services offered by his competitors in the cable industry.

“It is interesting that a lot of people have said, well, I can’t believe you’re going to partner with [cable companies],” McAdam said. “You are not going to use their Wi-Fi are you? Well, of course, we are. I mean we want to shift as much onto FiOS or onto the fixed network where we can and then provide — use that capacity to provide those higher demand services like video.”

McAdam added he does not want customers sitting in their homes watching video over his LTE 4G network. He also wants that traffic shifted to Wi-Fi.

“So our thinking going forward as we talk about kind of the ‘One Verizon’ approach is we want to use every network asset we have and if that means jumping onto FiOS or using the cloud services for mobile as well as fixed line, using security across all of our different access technologies, we want that network to be seamless and that is what our CTO, Tony Melone, is driving hard on in the business right now,” McAdam said.

One preview of that thinking at work can be found on Verizon Wireless’ hottest new device — the Samsung Galaxy S3. Verizon’s version of the phone browbeats customers with prominent menus that encourage Wi-Fi use wherever possible. The phone’s persistent reminder has become a pest according to many of the phone’s owners, who consider both the message and the difficulty keeping Wi-Fi shut off obtrusive.

Verizon’s partnership with large cable companies including Comcast, Time Warner Cable, Cox, and Bright House Networks originally involved the acquisition of excess wireless spectrum cable companies originally intended to use to compete with the mobile phone industry. With the cable industry abandoning those plans, the proposed collaboration involving Verizon Wireless grew to include cross-marketing each other’s products and services, and now apparently includes sharing the cable companies’ growing Wi-Fi networks.

Verizon Believes The Future of Telecommunications Needs to Be In the Hands of Two Companies — Verizon and AT&T

A point of shared belief between market leaders Verizon CEO Lowell McAdam and AT&T CEO Randall Stephenson is that excessive competition just does not make sense. Both believe federal regulators have it all wrong when they push to maintain the level of competition that still exists in the telecommunications business. When the Department of Justice effectively pulled the plug on a merger between AT&T and T-Mobile, Stephenson was outraged and, in one investor conference call, launched a tirade against regulators and suggested that AT&T would throw in the towel on expanding rural broadband in a retaliatory move.

A point of shared belief between market leaders Verizon CEO Lowell McAdam and AT&T CEO Randall Stephenson is that excessive competition just does not make sense. Both believe federal regulators have it all wrong when they push to maintain the level of competition that still exists in the telecommunications business. When the Department of Justice effectively pulled the plug on a merger between AT&T and T-Mobile, Stephenson was outraged and, in one investor conference call, launched a tirade against regulators and suggested that AT&T would throw in the towel on expanding rural broadband in a retaliatory move.

McAdam and Stephenson both believe that competition in telecommunications represents wasted investment, inefficiency, and value destruction.

“I think the fundamental problem here, and it is sort of like fighting gravity I think, is that it is so expensive to build these networks that you are not going to support seven or eight carriers,” McAdam told investors. “I don’t — frankly, I think you’ll be lucky if you can support three in a healthy environment.”

But McAdam recognizes that if it achieves a wireless duopoly with AT&T, it must be a benevolent one, or else the marketplace abuses the wireless industry has a track record engaging in will invite regulatory scrutiny.

“We have a tendency to create a great club and hand it to our detractors and say please beat me with this because we do some dumb things like fighting some of the number portability and trying to push a direct wireless directory,” McAdam said. “I mean there are things that have really upset customers and that invites regulation. So I think the industry has the responsibility to act in the best interests of the customer as part of the mix with a shareholder, but I think there is always going to be the battle with regulation.”

McAdam admits he is uncomfortable with the fact the Obama Administration has allowed the regulation pendulum to swing more towards enforced competition and checking the power of dominant carriers in the marketplace. He prefers the Bush Administration’s “hands-off” approach that allowed both Verizon and AT&T to snap up smaller competitors with scant regulatory review.

McAdam believes the Obama Administration’s FCC and Justice Department is slowing down wireless investment, innovation, and the industry’s ability to earn profits at a time when unemployment in sky high and increased investment will help drive the economy forward.

“This is nonsense,” wrote Lachlan Hunt. “Australia’s model of capped usage limits with higher prices for higher caps, and of ISPs including yourself offering free zones where such data doesn’t count towards the monthly quota is exactly the problem that Net Neutrality advocates aim to deal with. It treats data from companies who choose to partner with you to get their content in the free zone as privileged compared with everyone else, and similarly with other ISPs.”

“This is nonsense,” wrote Lachlan Hunt. “Australia’s model of capped usage limits with higher prices for higher caps, and of ISPs including yourself offering free zones where such data doesn’t count towards the monthly quota is exactly the problem that Net Neutrality advocates aim to deal with. It treats data from companies who choose to partner with you to get their content in the free zone as privileged compared with everyone else, and similarly with other ISPs.”

Subscribe

Subscribe