Frontier’s stock has reached the lowest level of the year after another disappointing earnings report.

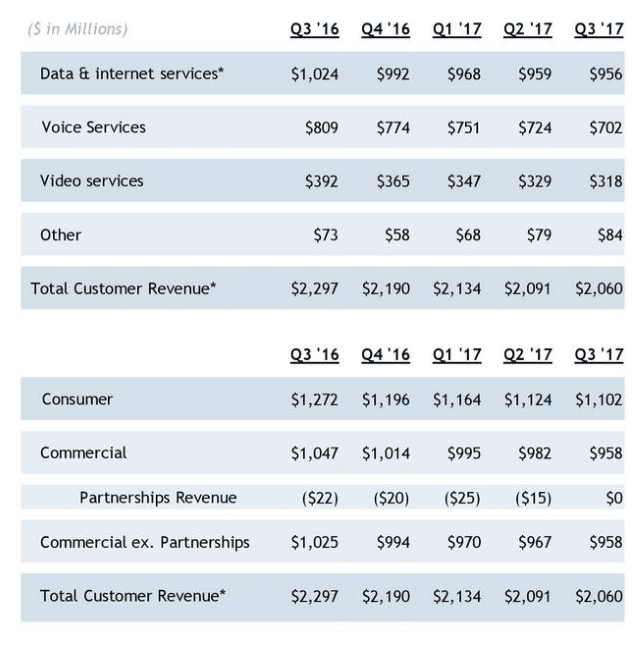

Frontier Communications turned in lackluster numbers for the third quarter of 2017, resulting in a wide selloff of Frontier’s stock, driving it to the lowest level it has seen in a year.

Investors are reacting to news the company missed earnings estimates once again, and many are losing confidence in Frontier’s CEO Daniel McCarthy, who has promised better results for more than a year. Frontier is rare among broadband providers, losing customers in virtually every segment of its business, including in its acquired FiOS service areas.

Frontier’s stock has lost more than 80% of its marketplace value so far this year — a stunning decline for a company selling broadband service in many areas where it maintains a monopoly.

McCarthy once again made a commitment his efforts will “stabilize” customer losses, but spent most of his time trying to reassure investors on a Tuesday conference call that those stabilization efforts will primarily target areas where Frontier sells FiOS fiber to the home service. Customer churn continues to be a problem, with many customers leaving either because the company alienated them or dramatically raised their rates after a discounted promotion expires. Either way, many of those customers switch back to a cable provider. McCarthy claimed Frontier plans to adjust promotional pricing to soften the blow of a steep rate hike after a promotion expires.

McCarthy said almost nothing about Frontier’s legacy service areas, where Frontier still sells copper-based DSL service. Some of the company’s biggest losses have been in areas where it cannot compete effectively with cable broadband. McCarthy offered to enhance customer retention efforts and increase marketing to reduce losses, but there are no indications Frontier plans to spend significantly on major network upgrades in these areas anytime soon.

Frontier declared an unexpected dividend of $0.60 a share, which some analysts consider excessive and represents a “red flag atop this toxic value destroyer.”

One analyst remarked, “I’m not buying it; Frontier is a business in free fall.”

Subscribe

Subscribe