Telecom companies are cutting investment in their networks despite promises by Republican members of the FCC that repeal of net neutrality would inspire increased investment.

Charter, Comcast, AT&T, and Verizon have surprised Wall Street with dramatic cutbacks in spending and investment in their networks, with one provider admitting improving profit margins are now a bigger priority.

As a result, Wall Street analysts are revising down capital expenditure (Capex) estimates in reports to their investor clients.

“Comcast and Charter missed [third quarter] expectations for Capex and guided 2019 lower than previously planned,” reported Nomura in a note to investors. “We have lowered our combined 2019 Capex forecast for Comcast and Charter from $14.6 billion to $14.2 billion.”

AT&T’s drop in network spending was the most dramatic among the country’s top telecom companies. AT&T has declared an end to fiber broadband expansion and slashed spending forecasts from the $23 billion the company spent this year to as little as $20 billion next year, despite claiming it would dramatically expand its 5G service to over two dozen cities over the next 12 months.

In a recent conference call with investors, AT&T CEO Randall Stephenson said “now it’s time to reap the rewards of what we’ve been doing [and] begin to reward to shareholders these investments that we’ve been making over the last few years.”

Over the next three years, AT&T will pay shareholders $45 billion in dividends and spend $30 billion on buying back shares of AT&T stock to retire debt racked up buying Time Warner (Entertainment). In fact, AT&T will devote 50-75% of its free cash flow exclusively on retiring shares of AT&T stock, which is expected to benefit shareholders.

Verizon reported spending $4.4 billion in the third quarter on network upgrades, approximately $100 million less than expected. That is a concern because Verizon is trying to expand its costly 5G network, but is not devoting the investment dollars required to make such an upgrade happen without cutting investments elsewhere in the company. Verizon has told Wall Street analysts to expect stable Capex spending of $17-18 billion annually for 2019-2021. That will either mean Verizon’s 5G expansion will be modest or the phone company will have to slash investments in other areas, such as wireline, fiber to the home, or business services.

Many analysts expect 5G will be a top spending priority for AT&T and Verizon over the next several years, leaving little room in budgets for upkeep of the company’s legacy landline networks or its other products. Charter and Comcast have effectively stopped spending on large upgrade projects, also as part of improved profit-taking.

The spending realities are in direct conflict with the promises made by Republican members of the FCC. Trump-picked FCC Chairman Ajit Pai repeatedly claimed that banishing net neutrality would lead to significant increases in investment by the nation’s top telecom companies. In fact, the opposite has happened.

Subscribe

Subscribe WASHINGTON (Reuters) – A U.S. appeals court on Tuesday rejected the decision of the Federal Communications Commission to declare that states cannot pass their own net neutrality laws and ordered the agency to review some key aspects of its 2017 repeal of rules set by the Obama administration.

WASHINGTON (Reuters) – A U.S. appeals court on Tuesday rejected the decision of the Federal Communications Commission to declare that states cannot pass their own net neutrality laws and ordered the agency to review some key aspects of its 2017 repeal of rules set by the Obama administration. Despite assurances from FCC Chairman Ajit Pai that the repeal of net neutrality would inspire cable operators to increase investment in broadband, a year-long virtual spending freeze by the nation’s top cable operators has resulted in a major vendor pulling out of the next generation cable broadband standard until there are signs cable companies are prepared to spend money on upgrades again.

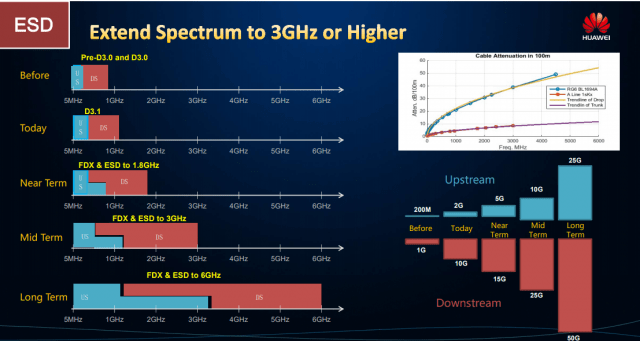

Despite assurances from FCC Chairman Ajit Pai that the repeal of net neutrality would inspire cable operators to increase investment in broadband, a year-long virtual spending freeze by the nation’s top cable operators has resulted in a major vendor pulling out of the next generation cable broadband standard until there are signs cable companies are prepared to spend money on upgrades again. FDX has already been the victim of delays. Originally planned as an incremental upgrade for DOCSIS 3.1, FDX is now scheduled to be included in CableLabs’ DOCSIS 4.0 specification, which is not expected to be released for a few years. FDX will be one of several new features incorporated into the next cable broadband standard, which will allow for low latency connections and an expanded amount of coaxial cable spectrum that can be devoted to broadband services.

FDX has already been the victim of delays. Originally planned as an incremental upgrade for DOCSIS 3.1, FDX is now scheduled to be included in CableLabs’ DOCSIS 4.0 specification, which is not expected to be released for a few years. FDX will be one of several new features incorporated into the next cable broadband standard, which will allow for low latency connections and an expanded amount of coaxial cable spectrum that can be devoted to broadband services.

While net neutrality in the United States has been neutered by the Republican-controlled FCC, the concept of an online level playing field is alive and well in Germany, and T-Mobile’s parent company Deutsche Telekom (DT) just got called out for a foul ball.

While net neutrality in the United States has been neutered by the Republican-controlled FCC, the concept of an online level playing field is alive and well in Germany, and T-Mobile’s parent company Deutsche Telekom (DT) just got called out for a foul ball.

Despite claims from Republican FCC commissioners that cable companies are boosting investment in their networks as a result of the FCC’s repeal of net neutrality, cable infrastructure suppliers reported first quarter 2019 revenues nosedived 38%, reflecting an “extreme” cutback in cable industry spending not seen in over five years.

Despite claims from Republican FCC commissioners that cable companies are boosting investment in their networks as a result of the FCC’s repeal of net neutrality, cable infrastructure suppliers reported first quarter 2019 revenues nosedived 38%, reflecting an “extreme” cutback in cable industry spending not seen in over five years.