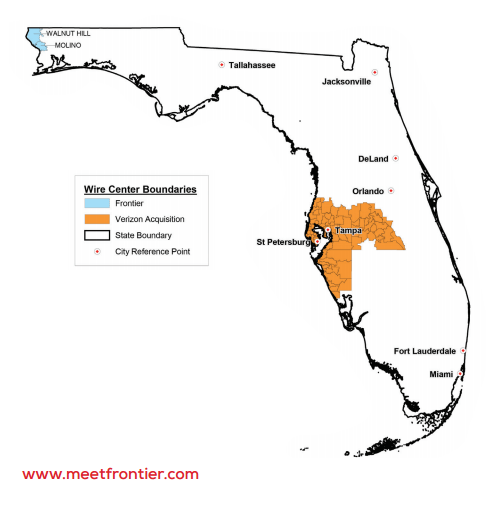

Frontier’s acquired service area in central Florida is depicted in orange.

Frontier Communications failed to attract any credible bids for its Florida service area it hoped to sell to raise cash to help pay down its massive debts, now reaching 23 times the size of the market value of its outstanding shares of stock.

Frontier’s money problems come largely from its 2016 $10.54 billion acquisition of Verizon Communications’ wireline operations in California, Texas and Florida (CTF). That added to Frontier’s debt, which now amounts to $17.8 billion, racked up mostly through acquisitions and merger activity.

After acquiring the ex-Verizon service areas, customers fled because of Frontier’s poor performance. Customers complained about lengthy service interruptions, inaccurate billing, and poor customer service. Frontier executives originally trumpeted the CTF acquisition as a crown jewel in the company’s portfolio. To some analysts, it now appears to be an albatross around the company’s neck, threatening to create serious financial problems when some of the company’s bond-financed debts mature in 2021 and 2022.

In February, a source told Bloomberg News the company could not expect to sell off its territories in one transaction, because there weren’t likely to be any buyers. Instead, Frontier offered buyers pieces of its network with the hope of attracting regional telecom companies, private equity and hedge fund investors, or local fiber optic service providers. In late May, Frontier revealed it had received multiple bids for pieces of its Florida operation, but no offer was adequately high enough to proceed.

Now that an asset sale appears to be unlikely, Frontier executives are in talks with their bondholders to figure out what will come next. It is a critical moment for the company, which is currently paying over $1.5 billion in interest annually, at an average interest rate of 8.1%. Refinancing debt could prove costly as interest rates have risen. Another option is bankruptcy reorganization, which other telecom companies have done to shed debt.

Frontier’s executives are in a difficult position. If they set the asking price for their assets too high, there will be no buyers. If they adjust prices downwards, it could attract fire sale buyers and signal the marketplace the company is desperate, weakening the value of its remaining assets.

“The Florida sale wasn’t going to de-lever the company meaningfully, but it would have given them a little more flexibility to handle their 2021 and 2022 maturities,” Lindsay Gibbons, an analyst at Creditsights, Inc., told Bloomberg News. “The problem is that they have a weak negotiating position. If they sold Florida for less than what they paid, it wouldn’t look good and it puts a watermark on the other asset values.”

Subscribe

Subscribe