Always looking for a new angle.

While T-Mobile and Sprint are preparing to battle it out offering dueling unlimited data plans, Verizon Wireless and AT&T are continuing to raise prices for many customers while pushing upgrades on customers some do not need.

This week, AT&T officially introduced its Mobile Share Advantage plan, with most of the advantages going to AT&T.

Per device fees have shot up by as much as 33% if you have more than two smartphones on your account. AT&T used to charge $15 per smartphone as a device fee. Now it is $20, offset in many cases by some reductions in data plan costs. But once you add a third device, you are paying a $5 rate increase per device.

The company is also trying to clean up its reputation by eliminating the scourge of data-related overlimit fee bill shock. Before the change, AT&T customers faced an overlimit fee of $5 for each 300MB used on its 300MB data plan and $15 per gigabyte on other plans. Instead of billing overlimit fees, AT&T is adopting punishing speed throttles for customers over their allowance. Once customers exceed their plan limit, speeds are reduced to 2G levels, up to 128kbps. While that is just painful for web pages, it makes watching video and uploading photos next to impossible without experiencing frustrating network timeout error messages.

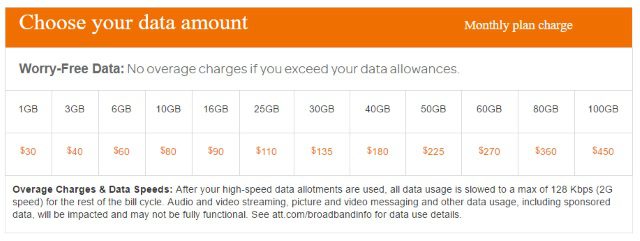

Gone are the 2, 5, and 15GB plans. Customers can now choose from 12 different usage plans ranging from 1-100GB.

But AT&T’s most conservative users of data are going to pay more under the new plan. Customers enrolled in the old 2GB $30 data plan, suitable for those who use their phones to check e-mail and view web pages, will find that same $30 will only buy them 1GB if they switch to the new plan. To avoid the likelihood of hitting the speed throttle, these customers will have to upgrade to a 3GB plan for $40 — a $10 increase.

For everyone else who happens to slightly exceed their data allowance, many may end up preferring the old $15 overlimit fee system. Under the new plan, customers have to live with speed throttles that make their devices almost unusable until the billing cycle refreshes. We predict many customers won’t wait and will upgrade their data plan to restore functionality. But upgrades from the 3GB and 6GB plans come in $20 increments — $5 more than the overlimit fee charged for slightly going over. Even worse, if the overage was a one-time issue, many customers will spend $20 more on a data allowance many probably won’t use.

Customers are free to keep their existing plan, for now. But if they change plans, they won’t be able to switch back.

Subscribe

Subscribe

Does anybody else remember back when AT&T DSL was $12.99/mo? Sure it was only 1.5Mbps, but I’m sure plenty of people would go for that speed at that price, today. Not an introductory price, no contract, no caps, no equipment charges, etc. Verizon similarly had $14.99/mo 1Mbps DSL, around the same time (circa 2006). Seems like they built-out their fiber network (and removed the copper pairs) just so they could drop the cheap DSL and force everybody to pay $55/mo, minimum for FIOS. The fed stopped requiring AT&T and Verizon to lease their lines to 3rd party providers (e.g. Earthlink),… Read more »

@rcxb,

it could be worse. You could live in Frontier Country where you pay $90 a month for phone + 1 Mb/s DSL. Fiber prices for smoke signal speeds. Great for the shareholders though because they get a dividend greater than earnings. Seems to me that if they can’t afford to upgrade anything, how can they afford to pay a dividend greater than earnings?

Ah the magic of corporate debt to pay dividends. They are not the first nor will they be the last to use debt to pay dividends.