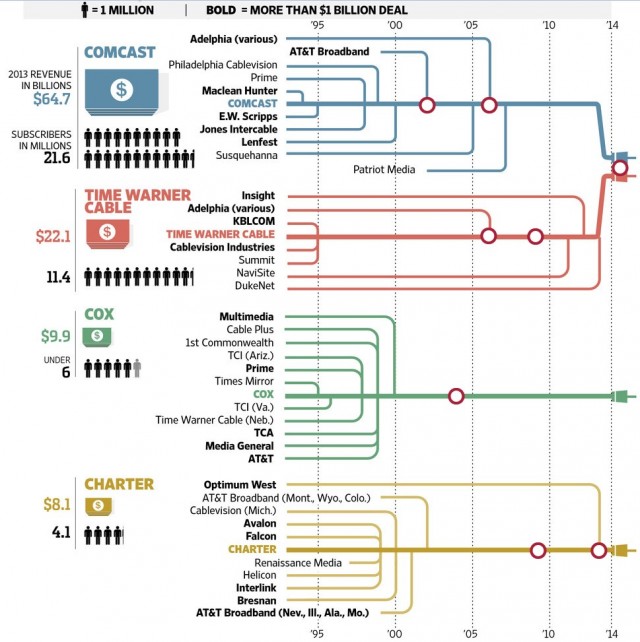

Bigger is not better. Despite endless claims that mergers, acquisitions and consolidation brings operating efficiencies and cost savings, for most customers it means only one thing: a higher cable bill. The Wall Street Journal traced the ancestors of some of today’s largest cable operators, cobbled together in takeovers, buyouts, and in the case of Adelphia, criminal activity leading to bankruptcy and absorption by Comcast and Time Warner Cable .

Wall Street analysts are pondering what deals are coming next, with Cablevision, Suddenlink, Mediacom, and Cable ONE all top targets. Among the current players, Charter is by far the most aggressive buyer and will likely be in the market for some or all of those smaller cable systems soon enough. Just remember, someone has to pay for those blockbuster merger deals, debt financing and executive bonuses.

Anyone in their 40s probably can recall companies like Jones, TCI, Falcon, Prime and Media General. They are all long gone, much the same way Bell Atlantic, SBC, Pacific Bell, BellSouth, and Ameritech have been absorbed into the AT&T and Verizon Continuum.

Subscribe

Subscribe

Phil,

1) Do you know of a similar graphic for AT&T, Verizon and Centurylink?

2) It just goes to show the network effect always wins out and that the core is far more valuable than the edge.

1) Try this: http://online.wsj.com/news/interactive/ATTMAP032811?ref=SB10001424053111904716604576542373831069388

2) Is that true? Why are edge providers’ ROI so much higher than network providers?

First, calling content providers and internet app companies “edge providers” is flat out wrong. It reveals how messed up perception is about carriers. They are all balkanized islands at the edge scratching for relevancy long term. We’re in a very long-term cycle that began 30 years ago and the final chapters are being written. The network effect (aka Metcalfe’s law) is often misunderstood. First, value grows geometrically as the core and linearly at the edge. Costs also decline at geometric rates as traffic scales while edge costs also only decline linearly. That’s why a core WAN voice minutes costs $0.0000004… Read more »

Since you didn’t answer the question, let me ask again: why does “the edge” have a higher ROI than “the core”?

I said the core has a higher value (ROI) than the edge, so what is the question? Are you confused by edge vs core? Who ever came up with the term “edge provider” for the content guys seriously needs a lesson in network dynamics, as this stuff has resided in datacenters on servers (aka the core) for the past 15-20 years. I was drawing clouds in 1990 as I described how datanetworks and “applications” would overwhelm regulated voice markets and service providers. Sorry if Cloud computing only became a concept in the early to mid 2000s; but it certainly predated… Read more »

Never mind, you’re not gonna answer the question, so I’m done.