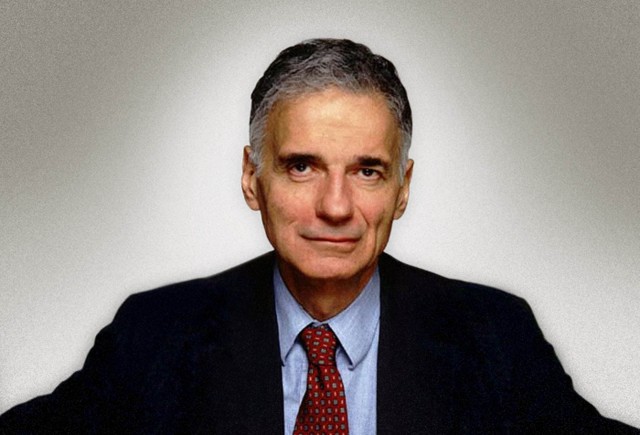

From the Desk of Ralph Nader

21 August 2013

Prime Minister Stephen Harper

Office of the Prime Minister

80 Wellington Street

Ottawa, ON K1A 0A2

Dear Prime Minister:

I read with interest that you are considering allowing Verizon Communications to operate in Canada with unique acquisition rights.

Bad idea.

Before you proceed any further, I suggest that you read a report by the highly regarded Center for Tax Justice and Good Jobs First titled, “Unpaid Bills: How Verizon Shortchanges Government Through Tax Dodging and Subsidies.”

Bottom line: Verizon is one of the country’s most aggressive corporate tax dodgers.

The report found that Verizon enjoyed some $14 billion in federal and state corporate income tax subsidies in the 2008-2010 period, even though it earned $33.4 billion in pre-tax U.S. income during that time. At the federal level, Verizon should have paid about $11.4 billion at the statutory rate of 35 per cent during the three-year period. Instead, it actually got $951 million in rebates, putting its federal tax subsidies at $12.3 billion. Its effective federal tax rate was 2.9 per cent.

The report found that at the state level, Verizon should have paid about $2.3 billion in corporate income taxes during the period but it paid only $866 million. Its aggregate state rate was only 2.6 per cent, far below the weighted state average rate of 6.8 per cent. This gave it state tax subsidies of about $1.4 billion.

Verizon also used a special tax loophole called the Reverse Morris Trust to avoid paying about $1.5 billion in federal, state and local taxes on the sale of its landline assets in various states.

The report found that Verizon also aggressively seeks state and local tax subsidies through credits, abatements and exemptions.

There is no centralized reporting on these subsidies, but the report documents $180 million in special tax breaks and grants Verizon and Verizon Wireless received in 13 states.

In addition to aggressively dodging taxes, Verizon also overtly rips off our federal government.

In April 2011, for example, Verizon paid $93.5 million to settle whistleblower charges that it had billed the government for “tax-like” surcharges it wasn’t entitled to impose on the government. Hidden surcharges on communication services have long been an unwelcome cost to business and consumers, and the General Services Administration had negotiated a firm, fixed-price contract with limited surcharges precisely to avoid being hit with hidden surcharges, the whistleblower alleged.

“Verizon was not only charging the government for the costs associated with communication services, but it also was pumping up its revenues by charging the government for Verizon’s own property taxes and other costs of doing business,” said Colette Matzzie, a Washington, D.C., attorney with Phillips & Cohen LLP, who represented the whistleblower. “Under federal law, Verizon was responsible for paying those costs, not the government.”

The settlement agreement covers the period from 2004 to 2010, when Verizon allegedly billed the government for a variety of surcharges including property tax surcharges, carrier cost recovery charges, state telecommunications relay service surcharges and public utility commission fee surcharges.

Question: why would you allow one of our country’s most aggressive tax dodgers, a company with a track record of overtly ripping off our government, into your country?

What’s bad for the United States will be bad for Canada.

Sincerely,

Subscribe

Subscribe

in my view if i was i canadian id let them come and welcome it competition is good who care what company its from