The billing address on file at Verizon Wireless can make a difference in your monthly bill.

The billing address on file at Verizon Wireless can make a difference in your monthly bill.

One Maryland man recently appealed for a refund of $840 when he discovered the wireless provider had specified his Bethesda workplace as his billing address, exposing him to additional taxes even though Verizon sends the bill to his Annapolis home.

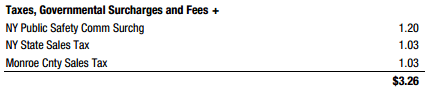

That distinction cost Larry Sisle an extra $3.50 a month — the difference between mobile taxes charged in Annapolis and those levied in Montgomery County, which includes the city of Bethesda.

Adding up the incorrect taxes applied to his two phones over the years he has been with Verizon revealed Sisle was potentially out hundreds of dollars and he wanted his money back.

In a classic “pass the hundreds of bucks”-move, Verizon told him to work with his local government to get a refund — a virtual impossibility for a telecommunications tax collected by a third party.

Make sure you are being billed the correct county and state taxes based on your billing address, not the location designated by your Verizon Wireless phone number.

“Excuse me? Why should I have to take this up with Montgomery County when it was Verizon who collected the tax incorrectly,” Sisle asked the Capital Gazette’s consumer watchdog.

A spokesperson for Montgomery County agreed with Sisle, telling the newspaper the phone company pays the tax directly, not the consumer, so the only recourse would be to pursue Verizon directly.

A Verizon Wireless representative eventually explained his Anne Arundel wireless number was accidentally put into the Montgomery County tax category in early 2010, which is what caused the error. That should raise eyebrows among other Verizon customers with Anne Arundel numbers that could have been overcharged as well.

Verizon says since the error has been ongoing only since 2010, it is processing a refund of just under $200 which will be credited to Sisle’s account.

Customers should scrutinize their Verizon Wireless bills, particularly checking to see if the company is appropriately billing state, county, or local taxes based on your billing address, not the city and county associated with your original Verizon Wireless number.

Subscribe

Subscribe

I live and use my cell phone in maryland and have been charged since 2010 NY state and Erie county surcharges and taxes. customer service not helpful…..