Four of the nation’s largest phone companies — two former Baby Bells, two independents — have very different ideas about solving the rural broadband problem in the country. Which company serves your area could make all the difference between having basic DSL service or nothing at all.

Some blame Wall Street for the problem, others criticize the leadership at companies that only see dollars, not solutions. Some attack the federal government for interfering in the natural order of the private market, and some even hold rural residents at fault for expecting too much while choosing to live out in the country.

This four-part series will examine the attitudes of the four largest phone companies you may be doing business with in your small town.

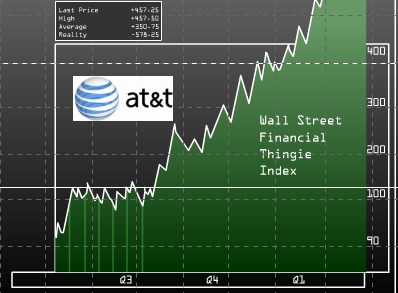

AT&T’s real priorities are to satisfy Wall Street demands for regular revenue growth. Rural wired broadband just cannot compete with the margins the company earns on its enormously profitable wireless and ARPU-raising U-verse services. (Graphic adapted from original work of Mark Fiore)

Today: AT&T — More Rural Broadband? Don’t Call Us, We’ll Call You

AT&T CEO Randall Stephenson earlier this year declared expansion of its U-verse fiber to the neighborhood service “largely complete,” despite the fact almost half of AT&T’s customers only have access to much slower DSL service, or cannot receive any broadband service at all.

For those living in AT&T’s service areas, which include a large portion of the midwest, southern states east of the Mississippi, Connecticut, and parts of California and Texas, Stephenson has not inspired confidence the company is rethinking what is possible in rural broadband.

“We have been apprehensive on moving, doing anything on rural access lines because the issue here is, do you have a broadband product for rural America?,” Stephenson told investors earlier this year. “And we’ve all been trying to find a broadband solution that was economically viable to get out to rural America and we’re not finding one to be quite candid.”

AT&T’s lack of confidence this year is in contrast with their bombastic rural broadband lobbying campaign of 2011, launched as part of an effort to win approval for its aborted merger with T-Mobile USA. The company sent slick talking points promoting the deal to community groups it supported with contributions, politicians it bought with contributions, and astroturf efforts it bankrolled with contributions.

The result was declarations like this from former Rep. Rick Boucher (D-Va.), who swept through Washington’s revolving door and came out on the other side working for AT&T-backed lobbyist-law firm Sidley Austin and serving as an “honorary chairman” of the industry-backed Internet Innovation Alliance:

Thousands of the smallest communities outside of urban areas either lack broadband service or have just one option that can be pricey for a relatively low connection speed, inadequate for modern business demands. The joining of AT&T’s and T-Mobile’s wireless spectrum will largely fill the gap and bring robust Internet connectivity to rural localities where wired infrastructure is cost prohibitive.

With the merger now nothing more than a bad memory, Stephenson’s interest in the innovation of Internet access quickly faded.

Last week, AT&T customers learned the company isn’t even interested in taking free money from the federal government and ratepayers to do better. Offered access to $115 million in broadband subsidies from the reform of the Universal Service Fund (USF), AT&T officials shrugged their shoulders and indicated they were not interested because they are not yet “ready” to participate.

“AT&T is in the midst of evaluating its options for further rural broadband deployment,” said Robert Quinn, AT&T’s senior vice president of regulatory affairs wrote in a letter to the commission. “As our chairman stated last month, we are optimistic about AT&T’s ability to get more broadband into rural areas, particularly as the technology continues to advance. However, until AT&T finalizes that strategy, it cannot commit to participating in the incremental support program. ”

For communities like Orangeburg, S.C., that answer is not good enough. The community received an $18.65 million federal grant of broadband stimulus funds to develop high-speed broadband in an area where only 20-40 percent of residents have Internet service today. AT&T is the dominant phone company and offered the same non-committal response to Orangeburg’s pleas for better service that the company gives to customers elsewhere.

While AT&T reports it is not yet ready to do better in rural South Carolina, it is very motivated to make sure nobody else does either, funding a massive lobbying effort in coordination with its friends at the American Legislative Exchange Council (ALEC) to pass a virtual ban on community broadband development across South Carolina.

Christopher Mitchell at Community Broadband Networks calls it “monetizing scarcity.” Orangeburg officials call it a big headache and are working around AT&T, frustrated with the phone company’s disinterest while it also helps build barriers to impede the community’s efforts to build its own network.

“If some of these other providers had a desire to serve these rural areas, they would have already been doing it,” said county administrator Bill Clark. “We are entering the broadband business because third-party providers are reluctant to provide the service.”

AT&T’s reluctance to accept USF money may have a lot to do with the company’s focus on its wireless network which is seen as a much more lucrative investment. Profit margins for barely-competitive wireless service remain sky high, and are growing higher as AT&T raises prices and the industry works to cut costs.

Even the company’s urban-focused U-verse network delivers opportunities for greater revenues from AT&T customers likely to buy additional services. Investing in DSL just does not pull in the same level of profits, and companies like AT&T will remain reluctant to expand rural broadband unless the government delivers a much larger government subsidy, according to Benjamin Lennett, a policy director at the New America Foundation.

“It underscores how flawed it is to rely on private companies to serve these rural areas where their margins are not going to be that high,” Lennett said.

Unfortunately for communities trying to work around AT&T’s roadblock, the company has made sure towns and villages building their own networks soon discover that road remains closed in more than dozen states thanks to AT&T with the help from corporate groups like ALEC, who feed willing legislators bills often drafted by the corporations they are designed to protect.

Subscribe

Subscribe