Despite concerns from consumer groups that a deal to exchange wireless spectrum in return for collaborative marketing between two competitors will lead to higher prices for consumers, the Federal Communications Commission seems prepared to approve it, according to a report from the Reuters news agency.

Despite concerns from consumer groups that a deal to exchange wireless spectrum in return for collaborative marketing between two competitors will lead to higher prices for consumers, the Federal Communications Commission seems prepared to approve it, according to a report from the Reuters news agency.

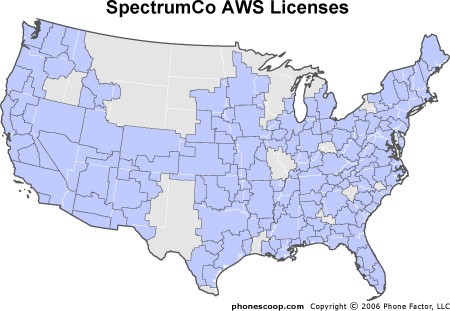

Two sources familiar with the matter told Reuters the FCC has taken the lead on the “spectrum transfer” issue, which involves turning over prime wireless spectrum currently owned by large cable operators Comcast, Time Warner Cable, Cox, and Bright House Networks to Verizon Wireless. The combined licenses the cable industry holds are in the majority of major American cities, which critics charge Verizon will acquire to eliminate any potential competitive threat from a new nationwide wireless carrier.

Verizon’s recent moves to sell off its own “excess” spectrum to its current competitors has garnered favor inside the FCC, according to sources. Verizon Wireless recently agreed to transfer some of that spectrum to T-Mobile USA, which coincidentally was a fierce opponent of the deal between Verizon and cable operators. T-Mobile’s opposition has since muted.

Licenses owned by the cable industry would have been expansive enough to launch a new national wireless competitor. (Image: Phonescoop)

The deal between Verizon and the nation’s top cable companies is worth about $3.9 billion, but the Justice Department continues to signal concerns it would ultimately cost consumers more than that. According to Reuters, Verizon remains in “tougher talks” with lawyers inside the Justice Department who are concerned cooperative marketing between the phone and cable companies would result in decreased competition and higher prices.

One source told Reuters regulators were hoping Verizon’s now-stalled fiber to the home network FiOS would bring major competition to the cable industry, which until then had only faced moderate competition from satellite dish providers. In return, Comcast and other cable operators were expected to invade the wireless phone marketplace, adding needed competition.

Instead, both sides have retreated to their respective positions — Verizon focusing on its wireless service and Comcast and other cable companies abandoning interest in wireless phones and sticking to cable-based products.

The idea that both would begin to cross-market each other’s products is “a problem” according to the Justice source not authorized to speak publicly.

Additionally, concerns are being raised over a proposed “joint operating entity” between Verizon and cable operators that would focus on developing new technologies that could lock out those not in the consortium.

No decision is expected from the Justice Department until August, but Justice officials have signaled they have several options they can pursue:

- Sue to stop the spectrum transfer;

- Force the companies to modify their proposal to reduce potential collusion;

- Approve the deal but monitor how cross-marketing agreements impact on consumer markets for wireless and cable products.

Subscribe

Subscribe