Windstream, one of America’s largest independent phone companies, has reported lower profits in the fourth quarter, declining four percent year-over-year to $72.4 million. Windstream’s core business continues to decline — losing another 36,000 landline customers during the quarter, as Americans continue to drop traditional telephone service.

Windstream, one of America’s largest independent phone companies, has reported lower profits in the fourth quarter, declining four percent year-over-year to $72.4 million. Windstream’s core business continues to decline — losing another 36,000 landline customers during the quarter, as Americans continue to drop traditional telephone service.

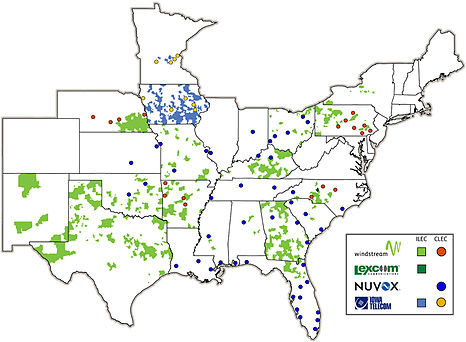

But Windstream’s ongoing acquisitions, as structured, are helping boost revenues on the company’s balance sheet. Windstream completed four acquisitions in 2010: the phone companies Iowa Telecom, Nuvox and Q-Comm Corp, and a data center operator, Hosted Solutions.

Although boosted revenue numbers can temporarily improve a company’s share price, investors are unlikely to ignore Windstream’s ongoing decline in profits for much longer. Windstream officials expect revenue growth for 2011 to remain flat, or potentially edge up by 3 percent. But part of that revenue growth comes from $40 million in broadband stimulus funding the company expects to receive from the Obama Administration during the year.

Windstream has made inroads in expanding broadband service in its largely rural service areas. The company added 12,000 broadband customers during the quarter, mostly for its DSL product.

Windstream’s results show a growing disparity between its residential customers and its business services unit. While growth on the residential side has been flat to anemic at best, the company is finding better results from its business customers. The decision to acquire a data center is part of the company’s growing strategy towards those clients. Windstream plans to spend a considerable amount of its capital during 2011 on improving its data hosting and wireless backhaul product lines to service these customers.

“We’ve made great strides in our business channel, which now represents roughly half of Windstream’s total revenue and importantly, these revenues are growing,” said Brent Whittington, chief operating officer at Windstream.

Windstream’s acquisition plans for 2011 appear cooler than in previous years as it attempts to reduce its leveraged debt. Most of Windstream’s growth has been attributed to its aggressive mergers and acquisitions strategy. The company, created in 2006 from Alltel’s landline division and Valor Telecom has grown into a national player, serving nearly 3.4 million customers in 23 states. Among its larger acquisitions — CT Communications (2007), D&E Communications (2009), and Iowa Telecom (2010).

Despite the lower profits, Windstream’s dividend payout ratio was 57 percent for the year, and the company expects to pay between 52 percent and 59 percent of earnings for 2011.

Subscribe

Subscribe

Shortly after Verizon started offering FiOS to it’s customers I wrote letters to Windstream suggesting that they needed to do something similar to keep up with the rest of the world. Over the last six years I’ve not seen any obvious efforts on their part to do so. I think if, instead of buying up other companies, they had instead reinvested in a fiber-to-the-home plan they would likely have increased their customer base by 36,000 instead of loosing them to cable and mobile providers. When the telco ISP is slower than the local cable ISP and just marginally better than… Read more »