This is part one in a series of stories illustrating how telecommunications companies use a combination of public relations firms, professional lobbyists, friendly regulators, and outmaneuvered state officials to sell “improved service” to the public in return for regulatory “reform.” Too often, that “reform” is loaded with loopholes and language that guarantees providers can break their promises, tie state and local regulators’ hands when bad service results, and ultimately stick you with the bill.

Over the past several months, several communities in New Jersey have been up in arms about Verizon’s reinterpretation of a state law originally written in the 1940s but “updated” just a few years ago, to mean it no longer has to pay telephone pole and infrastructure taxes to municipalities for using the public right of way. Verizon’s “reinterpretation” of the state’s Business Personal Property Tax law surprised several municipalities who now face significant financial challenges as a result of the lost revenue. New Jersey residents will likely make up the difference with a higher property tax rate.

Over the past several months, several communities in New Jersey have been up in arms about Verizon’s reinterpretation of a state law originally written in the 1940s but “updated” just a few years ago, to mean it no longer has to pay telephone pole and infrastructure taxes to municipalities for using the public right of way. Verizon’s “reinterpretation” of the state’s Business Personal Property Tax law surprised several municipalities who now face significant financial challenges as a result of the lost revenue. New Jersey residents will likely make up the difference with a higher property tax rate.

On the surface, it might appear Verizon simply happened upon tax savings. Verizon claims the law only requires it to pay taxes in communities where it has more than 51% of the area’s phone customers. Despite protestations from local officials, Verizon has signaled its intent to carry on, estimating 150 communities will join the 50-60 already impacted by next year.

Changes in telecommunications public policy do not occur in a vacuum. They happen when providers lobby for regulatory reform and bring gift baskets filled with promises for dramatically improved service. Using a network of high priced lawyers and public relations campaign experts, companies can easily outmaneuver local and state regulators at every turn. Unfortunately, by the time consumers (and sometimes regulators) realize they were left with a Trojan Horse filled with empty promises, it’s too late.

Some deals just bring consumers higher prices while others saddle communities with highly-leveraged, heavily indebted companies that eventually collapse in bankruptcy.

Just how did we get here? In this series, we’ll look at New Jersey’s history with its largest resident phone company. From New Jersey Bell to Bell Atlantic to Verizon, more than 20 years of questionable reform has left residents “touched” in their wallets. The blame doesn’t rest entirely with the phone company, either. Local and state officials were repeatedly won-over by professionally-run lobbying campaigns. After repeated bad experiences, one might assume they’d know better by now. Those communities no longer getting tax payments from Verizon can testify they haven’t.

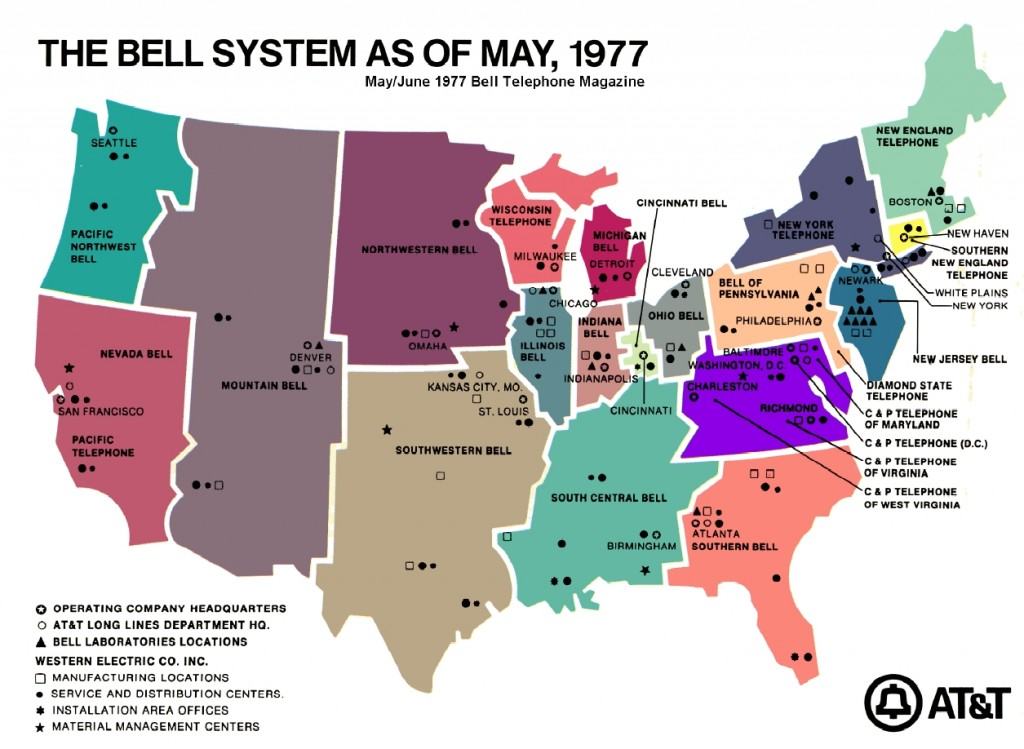

Let’s turn back the clock to the dramatic changes in telecommunications that came with the 1984 breakup of Ma Bell and the Bell System.

Telecommunications Industry Sets the Stage for a Money Party

[flv width=”640″ height=”500″]http://www.phillipdampier.com/video/1977 The Bell System.flv[/flv]

In 1977, the overwhelming majority of Americans were served by “the phone company,” namely AT&T and its family of Bell companies providing local service. (2 minutes)

For decades, telephone service was run largely as a monopoly by the enormous Bell System and several dozen smaller, non-Bell independent phone companies. Telephone service was regulated by state and federal authorities who approved rate increase requests and made sure providers met service quality standards. Consumers did not own the telephone equipment in their homes – it was rented from the phone company. Although often uninspired, Bell System telephones were often virtually indestructible, ranging from basic utilitarian black rotary dial phones to the flaunting Princess phone, which had a lighted dial and came in several colors.

As America began earnestly developing data transmission systems in the late 1960s and early 1970s, AT&T kept its monopoly intact there as well. At the time, a cooperative arrangement between IBM and AT&T ensured most American businesses would probably deal with one or both companies for their data communications needs.

The eventual fall of the monopoly glory days of AT&T and its Bell System monopoly can be laid at the feet of corporate arrogance, particularly from one John D. deButts who became AT&T’s new Chairman and CEO on April 1, 1972. deButts was AT&T born and bred, rising through the ranks over decades of employment with AT&T. To him, anything smacking of competition was to be considered a duplication of effort and wasted resources. AT&T, in his view, had already strayed too far from its past when Americans could go from coast to coast and deal with just one telephone system using uniform standards and practices of operations. Consistency and quality should be the highest priority for AT&T, not squabbling with smaller competitors fighting with each other for customers.

A politically tone-deaf deButts infuriated a post-Watergate Congress hellbent on reform at a time when Americans had grown suspicious of big power players, be they political or corporate. The confident AT&T executive delivered a speech before regulatory commissioners in the fall of 1973 that included within it, “[we must] take to the public the case for the common carrier principle and thereby implication to oppose competition, espouse monopoly.”

Not only did the speech irritate many members of Congress, it helped convince one of AT&T’s competitors, MCI to file a 22 count lawsuit against AT&T in March 1974, accusing Ma Bell of being engaged in illegal antitrust activities.

An even more important lawsuit was filed by the U.S. Justice Department on November 20, 1974. The federal government also accused AT&T of antitrust behavior, claiming the company locked-up the telephone equipment business for itself, and was well-suited to crush any potential competitor from getting a serious foothold in the marketplace. At the time, AT&T officials sniffed that the lawsuit was completely without merit and promised to fight back at all costs.

deButts ordered company lawyers to stall, delay, and roadblock the government’s case as much as possible, and the company enjoyed years of court delays. The lawsuit dragged through several preliminary hearings and motions, until the then-presiding judge, Joseph Waddy, fell ill and had to reduce his caseload. The United States v. AT&T was transferred to a newly-appointed District Judge named Harold Greene in September 1978. The days of delay were over. Greene quickly ordered the case to trial starting in September 1980.

While the court case saw some changes, AT&T did as well. In February 1979, deButts was out, replaced with a far more conciliatory Charles Brown. He changed AT&T’s tune, publicly welcoming competition into the marketplace, announcing “I am a competitor and I look forward with anticipation and confidence to the excitement of the marketplace.”

Having that attitude probably wasn’t helpful to defending AT&T’s case, and the company eventually threw in the towel, reaching a settlement with the government in 1982. Overseen by Judge Greene, AT&T was promised it could keep its long distance service, Western Electric (which manufactured telephone equipment), and Bell Labs, the company’s research and development arm. In return, it had to divest all 22 local phone monopolies.

Judge Greene, issuing a final consent decree to be effective January 1, 1984 formally broke up the Bell System. The 22 local phone companies under AT&T were merged into seven Regional Bell Operating Companies, each to be run independently:

- Ameritech (acquired by SBC in 1999 – now part of AT&T again)

- Bell Atlantic (acquired GTE in 2000 and changed its name to Verizon)

- BellSouth (reabsorbed back into a newly reorganized AT&T in 2006)

- NYNEX (acquired by Bell Atlantic in 1996 – later to become part of Verizon)

- Pacific Telesis (acquired by SBC/AT&T in 1997)

- Southwestern Bell (changed its name to SBC in 1995, then acquired the remnants of AT&T in 2005, rechristening itself as the ‘new’ AT&T)

- US West (acquired by Qwest in 2000.)

The goal was to create several smaller regional companies not too large to face challenging competition from new independent providers entering the marketplace.

The result of all of this upheaval was competition in the long distance calling marketplace, but very little competition for local residential telephone service over phone company-provided telephone lines.

Still, for a time the post-breakup family of former Bell companies enjoyed stability and a less regulated marketplace, and several raised rates for local phone service, even while cutting long distance prices. Customers could now buy and install their own telephone equipment, including answering machines and computer modems, and several competitors began to spring up to serve business customers.

By the 1990s, a new upstart appeared on the horizon that would potentially threaten the whole ‘arrangement.’ The cable television industry, subjected to a more regulated marketplace after years of monopoly abuse of customers, was looking for new unregulated add-on services they could provide to bring back the days of big profits they enjoyed just a few years earlier. Two potential services: providing connectivity to the Internet and providing cable customers with telephone service.

When phone companies realized cable was planning to invade their turf, this meant war.

In part two, learn more about how the telephone companies went ‘back to the future’ and rebuilt the empire Judge Greene broke up.

Subscribe

Subscribe

Good story and I look forward to part two. May I add a smaller detail of a section of time in Bell’s story? It did start with the big black monster phone. American quality at it’s best. Seems everybody had a job to. You could not kill those things with a brick. (Try that you I Phoner’s) A person used bell equipment to start because the phones required lots of power to ring. Then people noticed they could hook up a second non Bell phone themselves but back then each phone had a sticker with some sort of power usage… Read more »

I was 14 in 1982. It occurred to me, even then, that “forcing” the 22 Bell Telephone monopolies to “reluctantly” merge into 7 goliathan ones, was NOT monopoly busting!

Brad I hope part 2 or part 3 gives us some of the answers to your

very good question.

What’s interesting is tthat over the past ten years the telephone landscape has converged to the following major players, in order of size: AT&T Verizon Qwest CenturyLink (CenturyTel + Embarq fka Sprint) Windstream I’d include Frontier and FairPoint here, but they’re teetering on the edge of destruction at the moment, and are much smaller than the above companies. At this point Windstream is growing the fastest, while Verizon irs shrinking as quickly as it can to focus on largely unregulated triple-play service via fiber. Which is a good thing for folks who can get the fiber, a bad thing for… Read more »

“I’m guessing that Comcast will buy up TWC shortly, and Brighthouse will go shortly after. Cablevision probably won’t sell out, and neither will Insight. However I wouldn’t be surprised if Medicom was bought by Comcast down the road, yielding the cable equivalent of the Bell system remember, the Bells weren’t a monopoly everywhere; Sprint and CenturyTel were never Bells). So that leaves Comcast, Cablevision, Insight, Suddenlink and CableOne…I’d expect CableOne to be bought up by SL when the latter gets the chance after upgrading all their markets. Really rural areas will be left out in the cold in the name… Read more »