LUS Fiber - Lafayette, Louisiana's public utility municipal broadband provider, offers fast speeds with great rates

Frustrated communities across America, take note.

If your town or city government starts making serious noises about constructing your own, municipally-owned broadband network (especially one built with fiber optics to the home), existing providers who have repeatedly said “no” to requests for faster service at more reasonable prices have a track record of quickly turning around and saying, “yes — why didn’t you ask us before?”

Big existing telecommunications players loathe the thought of facing a new competitor in their midst. They are accustomed to the usual arrangement of one cable operator and one phone company. Cable companies provide cable modem service, phone companies mostly provide DSL. In smaller cities, and where a competitor is missing (or provides a lower quality service), there is almost no drive to upgrade. Cable will set speeds just above what the phone company is offering, and both will co-exist happily ever after.

For communities being bypassed by the fiber revolution now underway by Verizon, and to a lesser degree AT&T, requests from civic leaders, businesses, and consumers for upgraded service fall on deaf ears. ‘What you have now is good enough for this market, so be quiet and be lucky we give you what you’ve got now. Oh, and we’re raising rates, too.’

In Rochester, the one upstate New York city not on the “to-do” list of Verizon (which is merrily wiring urban and suburban communities across their service areas with fiber optic cable FiOS), Time Warner Cable sees little incentive to raise speeds or upgrade to DOCSIS 3 with a phone company competitor that has no apparent plans to move beyond traditional old school DSL service. Where FiOS does threaten, Time Warner Cable is in a hurry to provide “wideband” broadband as quickly as possible.

In Wilson, North Carolina, years of pleading from local officials to provide something beyond anemic broadband in their community was met with yawns from Time Warner Cable and Embarq, the local phone company. Wilson decided to build their own municipal fiber network, offering faster speeds at better pricing. Time Warner and Embarq did what most existing competitors do — they moved through the Four Stages of Telecommunications Competition Grief:

1) Behind the Scenes Threats and Anger: Companies work the phones with local officials trying to browbeat them into dropping the plans to construct municipal broadband, try to gin up partisan opposition, issue overinflated cost estimates, issue warnings about the trouble they’ll cause local politicians who support such initiatives, and snow a blizzard of documents illustrating how wonderful and reasonable their existing service is;

2) Stall Tactics Through Negotiation: Once home office is notified, a series of negotiations to attempt to forestall the project begins, such as throwing crumbs for incrementally better service, offers to build showcase mini-projects that represent a “win” for local politicians, or “looks good on paper” concessions that end up amounting to far less. Most of these discussions are designed simply to stall to allow the company to prepare for stage three.

3) PR and Legal Blitzkrieg: Assuming local officials haven’t been discouraged away from their idea, or dropped it after starring in a company-sponsored press event – ribbon cutting a small wi-fi or school connectivity project, the next stage is a multi-front battle involving company legal teams filing lawsuits to delay or kill projects, public relations and astroturf lobbying efforts to distort issues and build public opposition, legislative maneuverings to make such projects untenable through industry-friendly laws, and often vague promises about impending upgrades making the entire project unnecessary.

4) Acceptance, Competition, and Better Service: The final stage is the realization consumers don’t always get suckered by astroturf groups and company scare tactics. They accept the project is moving forward, and send out the press release saying they welcome the competition and are announcing their own significant service upgrade because “customers asked for it.” Price increases slow, speeds increase, and service improves, all because of the reality that an aggressive competitor is in their future.

Wilson city officials tried negotiations for better service, got nowhere, and had to fight back against a blizzard of nonsense from the telecommunications industry trying to legislate such projects out of existence with changes to state law. Americans for Prosperity, an astroturf group, even hassled residents in other nearby communities with robocalls to try and stop similar projects.

The arrival of Wilson’s Greenlight service, which offers speeds far faster than Time Warner and Embarq ever did, at lower prices, was a shock to Time Warner’s call centers. As customers canceled, representatives taking those calls were in denial residents were actually achieving the speeds Time Warner failed to deliver.

[flv]http://www.phillipdampier.com/video/Chattanooga Builds Fiber Network.flv[/flv]

Chattanooga’s public power utility fought back against telecommunication company propaganda to construct fiber to the home service across the city, which launched this year. (5 minutes)

In Monticello, Minnesota, local telephone company TDS had spent years refusing requests to improve service in the city. Speed and access issues plagued the community, northwest of Minneapolis. Local officials had enough and voted to construct their own fiber to the home municipal network.

Enter the four stages. TDS started by telling city officials the company’s network was state of the art for Monticello, and couldn’t be immediately improved because there was insufficient return on investment. Companies want to be assured they are paid back for investments they make, and because Monticello is a relatively small city, there were questions whether the costs for a fiber network would be paid back quickly enough through revenues.

When that didn’t work, the company sued the city as a stalling tactic. Despite the fact Monticello won case after case, TDS kept filing. A full assault by large telecommunications interests also began, trying to gin up public opposition. While the project was approved by voters, and Monticello was tied up in court, TDS quickly moved to stage four and started rapidly building their own fiber network in Monticello, actually putting down fiber the city was prohibited to wire themselves as the lawsuits dragged through the courts.

The company told Ars Technica that despite its earlier refusals to provide fiber service, TDS didn’t act earlier because it didn’t actually know that people really, really wanted fiber; once the referendum was a success, the company moved quickly to give people what it now knew they wanted.

Then, in June, the company said with the advent of its own fiber network, the city of Monticello should back away from constructing theirs, because its economic viability report was partly premised on the fact TDS refused to provide that service.

To underline that, TDS’ new fiber network doubled customer speeds to 50Mbps, trying to keep customers from taking their business to FiberNet Monticello.

[flv]http://www.phillipdampier.com/video/Vote Yes on Fiber.mp4[/flv]

Lafayette staged a multi-year battle with Cox and other providers to bring municipal fiber broadband to it’s corner of Louisiana. This 30 second ad promoted a “yes” vote on the project.

In Louisiana, Cox Cable is facing accusations it’s engaged in predatory pricing to kill Lafayette Utility System’s fiber to the home network and EATel’s fiber network in Ascension Parish. Cox Cable froze rates and moved in with DOCSIS 3 upgrades, delivering up to 50Mbps service. Cox chose to upgrade Lafayette before any other Cox-served community.

EATel, an independent phone company that wired fiber across Ascension Parish, also faced down Cox. When the cable company began promoting cut-rate pricing in Ascension, EATel took out advertising promoting Cox’s special prices — in other cities, much to Cox’s consternation. EATel’s ads, much like those run by Novus against Shaw in British Columbia, tell Cox’s customers to call the company and ask for the lower price they are advertising elsewhere.

“Cox came in with an incredibly aggressive promotion for TV service with every bell and whistle you could imagine. We couldn’t figure out how they could even make money on it. So we took out an ad in the Lafayette newspaper that basically said, ‘Hey Lafayette, look at the great prices you are going to get from Cox.’ Cox was not amused,” Trae Russell, communications manager for EATel told Telephony Online.

<

p style=”text-align: center;”>Joey Durel, Jr., president of Lafayette parish, testifies before the House Committee on Energy and Commerce on Lafayette’s municipal fiber network on February 27, 2008. (7 minutes)

You must remain on this page to hear the clip, or you can download the clip and listen later.

<

p style=”text-align: center;”>

Lesson learned — just threatening to bring in a municipal competitor is often all it takes to turn a persistent “no” from the local cable and phone companies into “yes, Yes, YES!”

Of course, not every project is successful. Some, such as Burlington Telecom Stop the Cap! reported on yesterday face political and cost challenges. Others are killed through stage managed opposition and astroturf campaigns paid for by the telecommunications industry before they even get started.

In North St. Paul this year, “PolarNet,” a planned fiber optic broadband network to stimulate the local economy was killed by an astroturf propaganda campaign undertaken by Qwest, Comcast, and other telecommunications companies that would have to deal with PolarNet as a competitor. The telecommunications companies claimed it would result in higher local taxes and “more government” where it wasn’t needed. Citizens defeated the proposal 67-33%.

Windom, Minnesota faced similar challenges and their fiber project was shot down in 1999, but with lessons learned, proponents brought it back up and won in 2000. To this day, the community of 4500 in western Minnesota face considerable envy from adjacent communities — they want service from the fiber-to-the-home system as well.

Almost universally, opponents to municipal broadband systems claim they are financial failures and saddle communities with debt. In reality, most have forced those opponents to provide improved service in their competitive communities, or those companies will become the financial failure.

[flv width=”427″ height=”240″]http://www.phillipdampier.com/video/Terry Huval of Lafayette Utility System April 2009.flv[/flv]

Terry Huval of Lafayette Utility System talks with the Fiber Revolution blog about the challenges Lafayette experienced building their own municipal fiber network. Huval offers excellent advice for other municipalities exploring similar projects. (April, 2009 – 10 minutes)

<

p style=”text-align: left;”>Thanks to Stop the Cap! readers Tim and Matt who suggested this story idea.

Subscribe

Subscribe

Fascinating article, very well researched. I can attest that the very same thing happened in France. After extensive lobbying by the incumbent telco against any change (including unkept promises followed by threats, etc.), in 2004, a law was passed to allow public authorities to build their own telecommunications network where the incumbent didn’t want to bulge. Exactly what you described happened, and… in the end France Telecom (now called Orange) has played to the tune set by elected officials. End result: in 2009 pretty much everywhere in France (98% of the territory), the very basic (minimum) broadband offer is 2Mb… Read more »

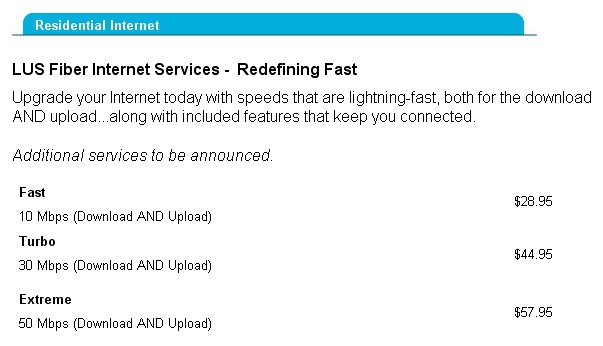

Not sure about TV, but Cox’s internet rates in Lafayette aren’t terribly competitive on the high end. In fact, LUSFiber’s $28 10 Mbit tier is faster on uploads than Cox’s $90 50/5 cable offering. It seems like the amount of effort a private telco/cableco will put into derailing a muni project via low prices and high technology is inverse to the size of that entity. As the telco/cableco gets larger they tend to just throw lobbying dollars at the issue. That’s what SBC (not AT&T) did in Lafayette awhile back. As far as I’ve heard, their 18/1.5 U-Verse service is… Read more »

Monticello is in Minnesota (not Wisconsin – that is where TDS is headquartered). Sure TDS is offering a $50 50/20 now (for how long, no one knows). But the muni offering is pretty decent too – 20/20 is the slowest package for $35/month.

I’ve always said that if there is no competition then these ISP’s have no incentive to upgrade because upgrading entails money and they don’t want to use some of their profits for that, oh no. They want to ride the gravy train as long as they can. In Charlote NC, despite Uverse offering 18/1.5 service, Time Warner hasn’t budged one bit on what it offers. Time Warner still maxes out at 10/512Kb. I guess the reason for is that the prices for Uverse aren’t as competitive to begin with so they aren’t seeing a massive exodus over to AT&T. I… Read more »

I just read this on Ars Technica and Maximum PC and submitted it for a news tip before I saw this article. Phillip is just too quick 🙂

So here’s the question – why hasn’t anyone in Rochester tried to start a municipal fiber effort?